Who Won BuzzFeed’s SPAC Debacle?

Since BuzzFeed went public last December, in what has become a poster child for the short-lived and ill-fated SPAC boomlet, former employees have been publicly anguished about the company’s limp stock price and their spoiled dreams of stock options turning into life-changing windfalls. Most notably, bureaucratic delays meant that BuzzFeed employees were unable to sell their shares on the day of the SPAC — after opening at $10, the price very briefly shot up to nearly $15 before beginning a swoon that brought it down to $6.25 a week later — and have dismally watched the price drop and drop since, closing on Wednesday at $2. Former staffer Hannah Anderson, who was a creative director from 2012 and 2016, told New York magazine that she’d hoped to pay for her kids’ college with the earnings from her shares. “We were so excited,” she said. “And then it just all came crashing down.”

In March, Anderson along with almost 80 other current and former employees, many of whom say they joined when the company was a startup and accepted lower salaries because they hoped their options would one day be worth a tidy sum, filed two complaints against the company, asking for more than $8.7 million in compensatory damages.

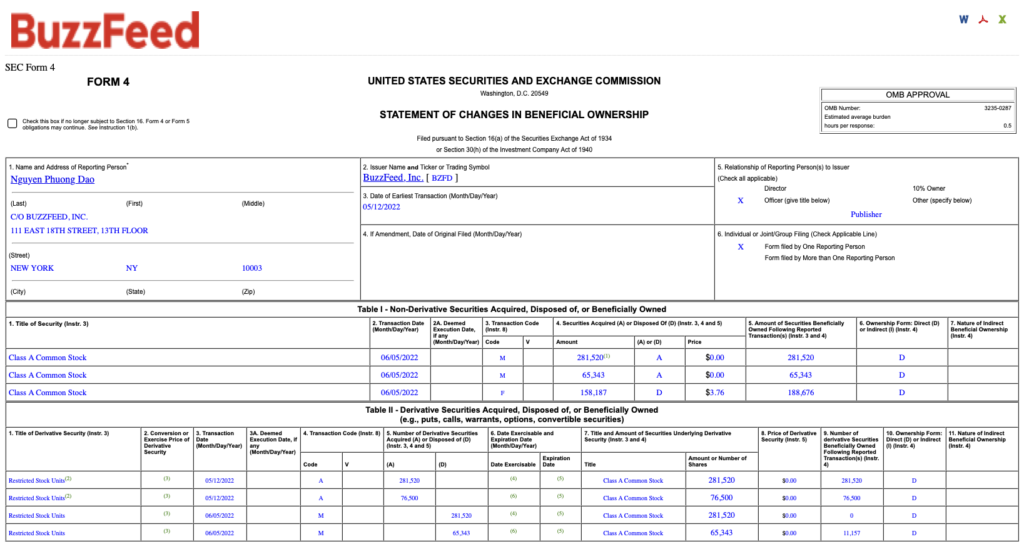

There were, however, some winners of this BuzzFeed SPAC debacle. Though executives were not allowed to trade for six months and, like other stockholders who experienced significant delays, watched as the stock price dropped over that period, the numbers of shares some executives hold means that sizeable windfalls are still within reach. On June 5, SEC filings show that three company officers disposed of over a third, but less than a majority, of their Class A common stock at $3.76 a share. Chief legal officer Rhonda Powell disposed of 57,460 shares which comes out to $216,049.60, leaving her with 101,914 shares worth $203,828 at Wednesday’s close. Chief financial officer Felicia DellaFortuna disposed of 67,426 shares, totaling $253,521.76, leaving her with 111,838 shares worth $223,676. And publisher Dao Nguyen disposed of 158,187 shares, equalling $594,783.12, leaving her with 188,676 shares worth $377,352.

The transactions were all labeled with the code F, which the SEC defines as “Payment of exercise price or tax liability by delivering or withholding securities incident to the receipt, exercise or vesting of a security issued in accordance with Rule 16b-3,” which translates to them not receiving those windfalls directly, however, the sales likely covered income taxes owed on their stock compensation they otherwise would have paid out of pocket.

Some executives are still stuck holding on to their stock. Christian Baesler, chief executive of Complex Networks who became BuzzFeed’s chief operating officer when his company was acquired as part of the SPAC, will have to wait until December 4 for his first 229,500 shares to vest with another 71,942 shares vesting on February 15, 2023. Over the next two years, he has an additional 602,885 shares scheduled to vest.

And BuzzFeed founder and chief executive officer Jonah Peretti has yet to file any forms to indicate he’s disposing of any of the more than 6 million shares he owns, according to corporate filings.